Leveraging Residual Values for Fleet Owners and Lender Decisions

Commercial Truck Residual Values

Understanding the value of a vehicle is an important step in purchasing, leasing, renting, and selling fleet assets. No matter how long an owner plans to keep a truck, knowledge of the residual values will provide the insights needed to make the right asset decision when the time comes.

Leveraging residual values is very popular among the industry professionals who analyze fleets or individual assets to determine the total cost from purchase to resale. Since there are a lot of comparable models on the Commercial Truck market, deciding how to choose the make and model with the best value is key in fleet management. Utilizing insights from industry experts, such as the average length of truck ownership or average mileage on a model within the market, should drive asset risk assessment decisions on whether or not to finance a fleet given the current inventory.

Why Residual Values Matter

The average age of a used class 8 commercial truck on the market today is six years. It means that once trucks get to the 5-7-year range, fleet owners start trading them in for newer models. This observation begs the question:

What impacts the initial fleet purchasing decision?

The answer to this is rooted in understanding the value of the truck at the moment when the owner is ready to update the fleet. One recommended practice is to utilize the 7-year residuals that accurately estimate fleet asset values when it’s time to replace the assets. While it is true that the new model truck sales might decrease from the growth of the used vehicle market share for the 2012-2015 and 2016-2017 model years, the Price Digests analysts still find that the average age for nearly 60% of all used commercial trucks on the market stays between 5 to 8 years.

Price Digests Tools for Commercial Truck Residual Values Assessment

Price Digests offers VIN-level commercial truck residual values assessment to help financial industry professionals to calculate an accurate current value including adjustments for the vehicle mileage. To forecast the 7-year residuals, a fleet manager should account for future vehicle mileage using an annualized increase in mileage for the desired future period. If the current mileage of a truck is unknown or zero (for a brand new vehicle), an average annual mileage based on current market usage trends can be used in predicting the mileage at the end of 7 years.

Best Practices in Vehicle Value Adjustment

Truck owners should remember to include additional equipment details such as an engine upgrade as they largely impact the future value of the asset. Assets that are not adjusted for upgrades in components and current mileage may be undervalued by thousands of dollars throughout the course of a financial period. For example, the difference between a properly adjusted and unadjusted Volvo VNL 300 at 7 years of age is $1,292. At 5 years, the difference is $1,713. With an average fleet consisting of 20+ trucks, the financial impact of poor adjustment practices could result in a substantial financial error.

Best Practices in Fleet Disposition

Commercial truck residuals provide insight into when to offload a truck from the fleet for the best return on investment. Depending on the truck and market, it may be best to sell earlier or later than planned. Some of the fleet management questions to think about might be as follows:

- What do maintenance costs look like if I keep the truck on the road for another year?

- Will the maintenance cost of an asset exceed the difference in the residual value if a truck is sold in year 6 vs. year 7?

- What is the expected market share for this truck make, model & age when I am ready to sell?

- How do these factors affect ROI?

Truck Depreciation

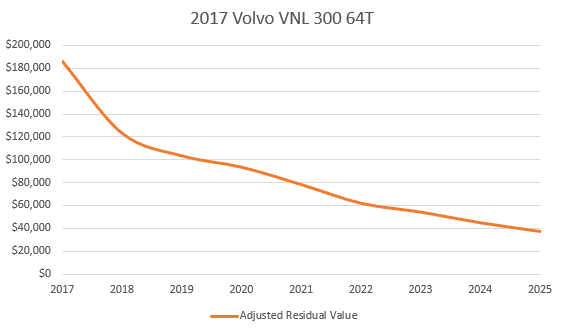

Trucks take the highest depreciation hit within the first two years if purchased brand new. The below graph shows how the listed MSRP for a 2017 Volvo VNL 300 compares to the used value of the same vehicle in 2018 and beyond.

Since the practice of releasing upcoming year model in the previous year is widely practiced among many different manufacturers, many 2017 models get released in 2016. By 2017, the value of the 2017 models produced in 2016 will be lower than the MSRP and the original purchase price, whether used or not.

Inventory valuation principles will also lead to unsold 2017 trucks to drop in price and make room for the new 2018/2019 models. At the same time, the sold 2016 and 2017 vehicles will be actively increasing their mileage. The average mileage on a typical heavy-duty truck in its first year of ownership is about 11,000 miles. By year 3, recorded mileage significantly increases to an average 300,000 miles traveled.

Leveraging the Residual Value Curve

A residual value curve is an invaluable tool that visualizes the dynamics of an asset value change. As the model popularity in terms of resale peaks when trucks reach 5 to 7 years of age, the residual value curve begins to level out for the mileage within a +/-150,000-mile variance from the market average. For the assets with mileage much higher than normal, or average, the value drop cadence accelerates by several thousands of dollars.

For Class 8 trucks, the average mileage begins to flatten at 6 years. This condition dictates an earlier disposal of these assets which end up being sold much earlier with fleet managers getting rid of their trucks based on mileage and condition rather than the age alone.

If a truck owner knows the average mileage the truck will accrue each year, a residual value curve could assist in determining the truck’s value and figuring it into the decision making at the time of purchase.

Residual Values Utility for Lenders

It is good practice for lenders to request an estimated annual usage for each financed truck in their book of business. Asset usage knowledge could impact the present and future values of the current portfolio and affect lender’s planning for future opportunities. With the assistance of Price Digests’ industry experts, insights into the popularity of certain truck models, model years or types are detrimental in identifying areas of risk on an asset.

Intelligent Fleet Management is a Success Factor

Considering continuous market changes and supply and demand fluctuations that impact the value of a commercial truck, calculating the appropriate length of use and future resale value may initially seem difficult. The usage, popularity, and specifications (i.e. equipped engine) will impact such calculation. Thus, having a vehicle values data provider that offers access to the most granular vehicle specs is the only way to operate with the most accurate current and future values of a commercial commercial fleet or its individual pieces.

Founded in 1911, Price Digests has been the nation’s original vehicle valuation source for over a century. The ultimate fleet valuation authority, Price Digests offers a database of VINs that covers the widest range of fleet categories – from commercial trucks and trailers to boats and RVs. Since its very beginning, the Price Digests’ mission was clear – to render dealers, fleet owners, government, finance and insurance industry professionals of the United States an immeasurable service, enabling them to save countless millions of dollars through its accurate identification data and market quotations of used vehicles.

Schedule a demo today to learn how the Price Digests valuation solutions can increase your fleet management efficiency and accuracy in estimating fleet residual values. Or, you can inquire about other custom consulting solutions that Price Digests offers.

Jessica Carr

Senior Industry Analyst

Price Digests

Asset Intelligence

Infrastructure intelligence | informa