Heavy-Duty Trucks: Stabilizing, But Are We Hitting Cruise Control?

It’s been quite the ride in the trucking industry these past few years, hasn’t it? The shifts, the turns, and the bumps: it felt like navigating a rocky mountain road in a heavy downpour. But, are we finally seeing the clearing skies over the horizon? Is the heavy-duty truck market finally finding its groove?

Price Digests’ most recent 2023 Truck Market report paints a hopeful picture: the used medium and heavy-duty truck market shows signs of recovery despite the fact that the beginning of this year presented a mixed bag for the industry. Concerns about a potential recession, slowing demand, and the uptick in interest rates caused many to worry for this year’s outcome. And if we look at FTR’s Trucking Conditions Index (TCI), a dip in freight rates and volumes casted a shadow on the commercial trucking environment. Yet, should we only be seeing this as a quickly passing storm?

Sometimes, a little cooldown is exactly what we need to reset and recharge. And that’s precisely what seems to be happening here. Manufacturers and sellers might just have found that coveted window of opportunity to iron out persistent supply chain wrinkles. And for the buyers, it’s a chance to possibly stretch that budget a tad further.

Remember those days when the demand for commercial trucks was soaring so high it almost felt unreal? But the supply side of things was like a parched desert. Quality, especially in terms of age and mileage, remained a sticky point. But with prices now on a steady decline, there’s a collective sigh of relief. Could this be the balancing act the market desperately needed?

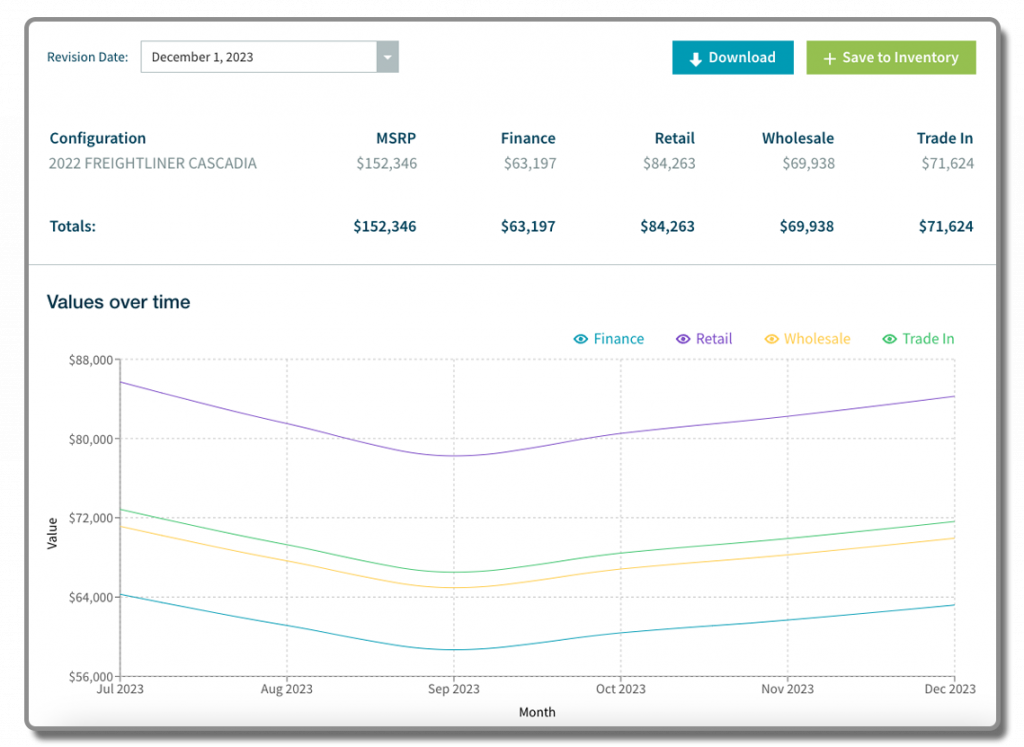

Diving deeper into the heavy-duty trucks category, the narrative remains intriguing. Prices have been on a downward spiral, almost mirroring the scenario two years ago. Although still a bit above the pre-pandemic markers, the current rates seem to be on a journey back to more familiar territories.

As for the average age of these behemoths? We’re looking at 9.3, which, albeit higher than desired, is a welcome change from the staggering 9.9 in Q4 of 2021. However, both the mileage and age stats hint at a broader underlying issue: new heavy-duty truck inventories might still be caught in the whirlwind of disruptions.

Driver oversupply is posing a curious dilemma. With more drivers looking for jobs than there are positions available, what does this mean for the future dynamics of the industry? And let’s not get started on fuel prices. After giving us a brief moment of joy with lower costs, diesel prices are on the ascent again. Ah, the ever-turbulent dance of the energy markets!

But, in such dynamic times, ensuring these hefty investments are well-insured is paramount. The commercial truck insurance sector has its challenges cut out, with inflation doing the cha-cha and settlements skyrocketing.

For insurance carriers, every penny counts, and ensuring there’s no leakage is essential. And here’s where Price Digests’ TruckBody IQ® comes to the rescue. By providing swift and comprehensive access to commercial truck values, underwriters are now armed to craft the most precise quotes at record speeds.

So, where do we stand today with heavy-duty trucks? We’re witnessing stabilization, but the journey is ongoing. With tools like TruckBody IQ® and in-depth market insight like Price Digests latest Truck Report, the road ahead, while challenging, promises exciting possibilities. The question now is: are we ready to embrace the ride?