Reducing Commercial Insurers’ Risk Exposure with Better Truck Intelligence

When it comes to mitigating risk in commercial auto insurance, accuracy makes all the difference. Insurers have a wealth of data available to them—from driver speed to truck utilization—but that data is only available once the vehicle is in use. At Price Digests, we’ve noticed that there’s still a critical gap in information at the underwriting stage.

Here’s why commercial trucks are underinsured so often, and what insurers can do to change the status quo.

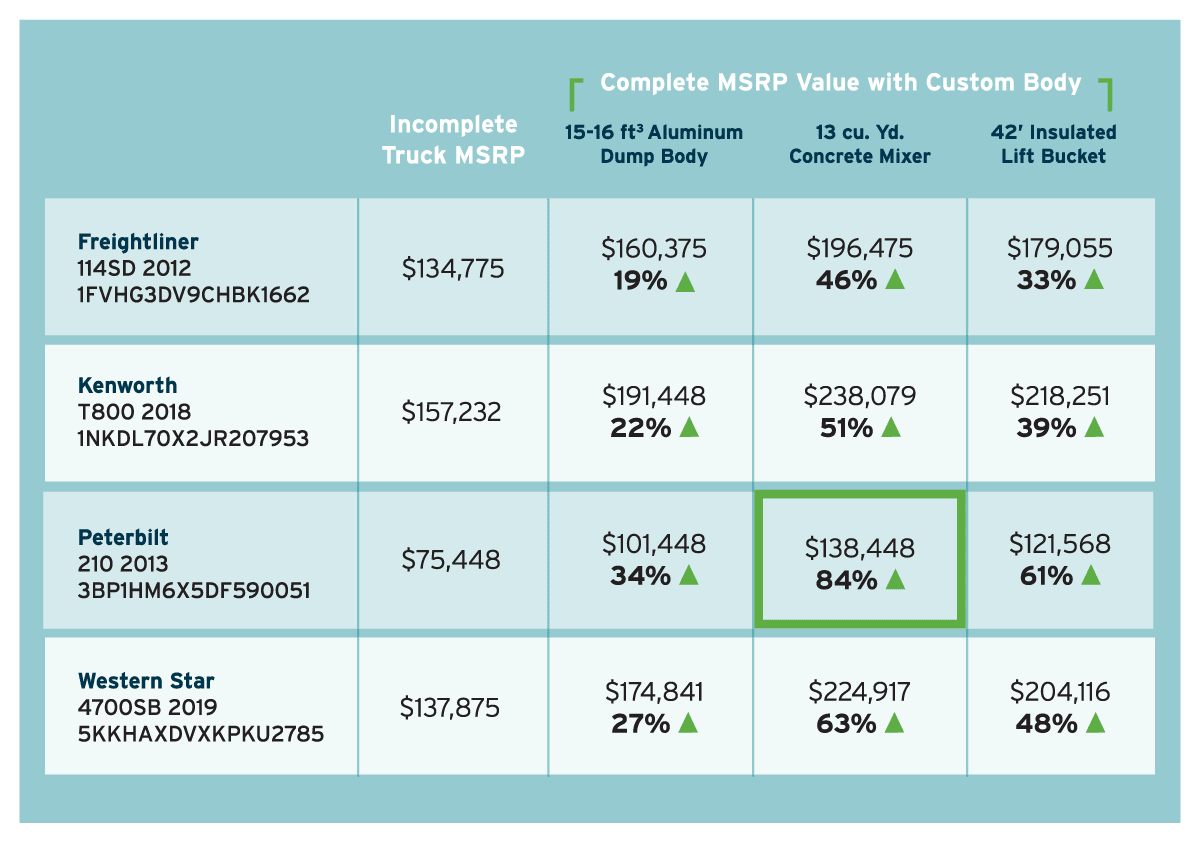

How Complete vs. Incomplete Truck Values Can Vary

Before a truck can begin its useful life, it needs additional customizations on the cab & chassis. In this incomplete stage, it’s impossible to accurately assess the vehicle’s Original Cost New (OCN) without data sources similar to Price Digests. As a result, many insurers underestimate OCN, which sets the stage for premium leakage in the future.

The customizations needed to make a truck complete are specific to the needs of the business, and the specialized applications of the truck. For example, a medium-duty cab and chassis can be upfitted with a dump body for construction work, a flatbed for towing vehicles, or turned into a box truck for making local deliveries.

There’s no way to tell what the final configuration will be by the VIN alone, being that VINS are assigned at the cab & chassis’ production. Bodies are then installed post VIN assignment. To illustrate this point further, we pulled market data on several different truck models and various configurations.

As you can see, the final configuration can drive up OCN by more than 80%. Even a 20% increase in OCN can significantly increase an insurer’s risk if it’s not captured during the underwriting process.

Common Hurdles to Underwriting Accuracy

Every underwriter takes accuracy seriously, but insurers face numerous pressures and limitations that get in the way of integrating more data into their processes:

● Pressure to improve speed to quote

● Inability to access data due to antiquated or disjointed technology

● Difficulty modernizing underwriting practices

Because of these hurdles, underwriters typically have to request information about final truck configurations, which disrupts the quote process.

On top of these issues, the industry as a whole is facing profitability challenges due to the increased severity and frequency of commercial auto claims. It’s more urgent than ever for insurers to access automated, advanced analytics that can close the data gap in the underwriting process.

The Solution: Better Truck Intelligence

New developments in insurtech allow insurers to gain better information and correct understated premiums. Tools like TruckBody IQ®, leverage decades of real-world data and a deep understanding of industry-specific truck configurations to predict final buildouts and take the guesswork out of estimating OCN.

When you can be confident that you’ve captured the full vehicle value, you can set premiums with confidence and reduce your exposure to risk. We put together a white paper that outlines how these solutions like TruckBody IQ® work in more detail. Download it here to learn more.

About Price Digests

Since 1911 Price Digests has served the vehicle data needs of the insurance, finance, government, and dealer markets through its portfolio of VIN decoding, specifications, and market value data solutions for the commercial truck, passenger vehicle, marine, powersport, and recreational vehicle asset classes. Our data + intelligence solutions pave roads to faster and better decisions with perfect-fit data delivery, whether it’s seamlessly integrated APIs, online subscriptions or custom data delivery.