Impacts of chip shortages and production delays felt on the resale channel

Chip shortages¹, supply chain hiccups, production slowdowns, and strong demand² for new commercial trucks. Given this mix, it has been no surprise to see list prices on the resale channel rise. Beyond just the prices, though, our Price Digests analysts wanted to dig deeper into the data to help you understand how this has impacted the age of commercial trucks for sale, how long commercial trucks are being listed before being sold, and how these trends are playing out for specific types of commercial trucks.

Resale prices and vehicle ages on the rise, time on market declines

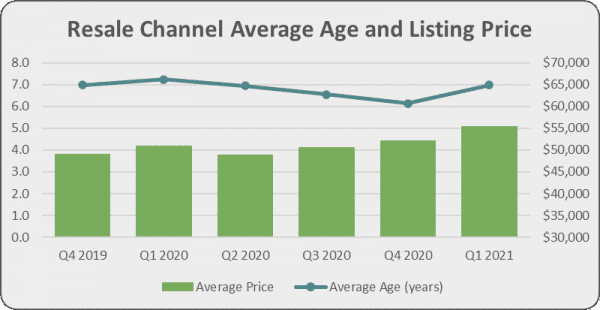

Average list prices for commercial trucks (classes 4 through 8) have been increasing since Q2 2020. Comparing average prices from Q2 2020 to Q1 2021, we have seen overall increases of 13.6%, with heavy-duty trucks up 12.2% and medium-duty trucks up 20.8%.

A trend we observed throughout 2019 and 2020 was commercial trucks on the resale channel skewing newer and newer. The latest data from Q1 2021 shows a bump in average overall age, which may be partially explained by the change in the calendar year and how that impacts the calculations. However, as you will see in the sections below specific to heavy and medium-duty trucks, the increase in age is more than a transition to a new calendar year for the listings of the heavy-duty truck.

Overall, the average age of commercial trucks on the resale channel was 7.2 years in Q1 2020, dipping to 6.1 years by Q4 2020, and popping back up to 7.0 years in Q1 2021. This increase in average age is likely a reflection of fleets awaiting delivery of new heavy-duty trucks, delaying their ability to list their later model vehicles for sale, making the resale channel skew more toward older model years.

Despite the higher prices, demand on the resale channel appears to be quite strong. Based on an analysis using a sample of more than 35,000 monthly VIN listings, we have determined an average time on market* of 2.3 months in Q1 2021, down from an average of 3.1 months in Q2 2020. This metric indicates vehicles are sitting on the resale channel for nearly 1 fewer month, suggesting stronger demand.

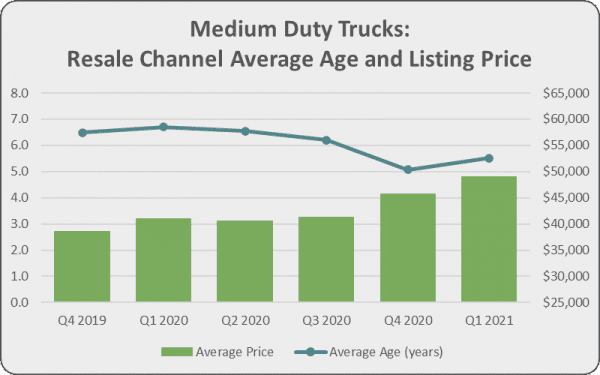

Medium duty truck prices up 20.8%

As mentioned previously, average prices for medium-duty trucks on the resale channel have increased 20.8% from Q2 2020 to Q1 2021. The age of resale listings also started to increase in Q1 2021 reaching an average of 5.5 years. Although, that is still more than a year shy of this truck category’s most recent high of 6.7 years in Q1 2020 and lower than would have been predicted based on average age of 5.1 years in Q4 2020 and the change of the calendar year into 2021.

The higher prices for medium-duty trucks does not yet seem to be a deterrent on demand. Compared to the commercial truck resale channel overall and heavy-duty trucks specifically, medium-duty trucks had the lowest average time on market* at an average of 2.0 months in Q1 2021. That is down from an average of 2.9 months on the market in Q2 2020.

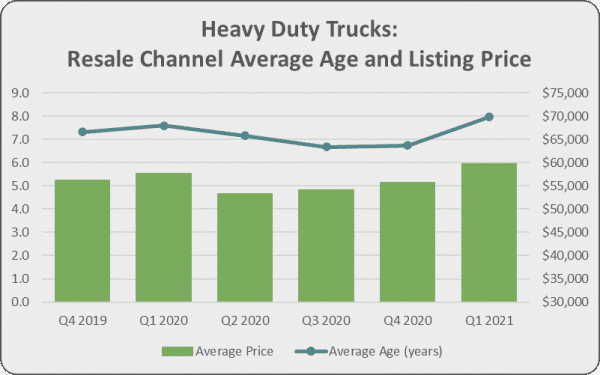

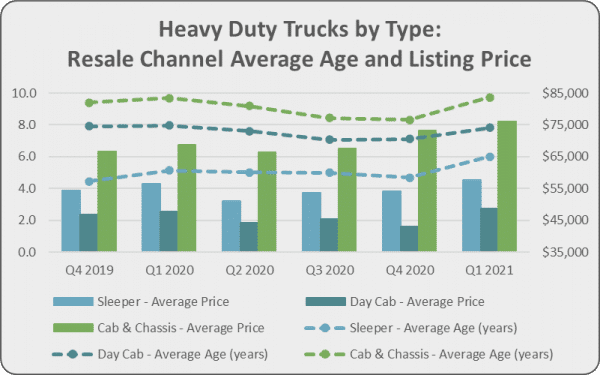

Heavy-duty truck prices up 12.2%

From Q2 2020 to Q1 2021, average resale list prices increased 12.2% for heavy-duty trucks. We also observed a more dramatic increase in average age for heavy-duty truck listings, increasing from 6.7 years in Q4 2020 to 8.0 years in Q1 2021. As mentioned previously, this bump in average age contrasts a trend we observed throughout 2019 and 2020 of average heavy-duty truck ages skewing newer and newer on the resale channel. In particular with the heavy-duty trucks, this increase in average age is likely directly tied to the production and delivery delays recently reported1.

Demand for heavy-duty trucks also seemed quite strong in Q1 2021, with an average time on market* of 2.5 months, down from an average of 3.1 months in Q2 2020.

These trends of higher average list prices and higher average age held true for heavy-duty sleeper tractors, day cab tractors, and cab and chassis trucks. The largest increase in average prices was observed with cab and chassis, which increased 14.6% from Q2 2020 to Q1 2021. Cab and chassis trucks also experienced a pronounced increase in average age, rising from 8.3 years in Q4 2020 to 9.7 years in Q1 2021.

Cab and chassis were the only heavy-duty truck type that did not see a decrease in average time on market*, staying relatively flat from 3.0 months in Q2 2020 to 2.9 months in Q1 2021. Sleepers and day cabs both had stronger demand, with sleepers dropping from 3.3 months to 2.2 months and day cabs dropping from 3.0 months to 2.5 months over the same time period.

*Time on market: This proprietary Price Digests metric is based on tracking of resale listing VINs and provides insight into how many months the commercial truck has been for sale. A value of 1 indicates the commercial truck was newly listed on the resale channel. A value of 6, for example, would indicate the commercial truck currently listed had also been listed for the previous 5 months. Lower values suggest higher demand and turnover on the resale channel.

Articles Referenced:

[1] Logistics Management: Computer chip shortage stalls Class 8 production, further dampening trucking capacity. Retrieved April 12, 2021

[2] Fleets ‘need more trucks and trailers’ as supply chain clogs. Retrieved April 12, 2021