Higher Prices, Fewer Options: What’s Happening With the Roaring RV Market

With summer vacation season approaching, and RV owners hitting the roads and the campgrounds, we thought now would be a good time to look at how the RV market has been impacted by recent events. To do this, we compiled data on RV models produced over the last ten years, along with their MSRP by model year. Part of what we uncovered shouldn’t come as a shock to anyone: RV prices are on the rise, primarily due to increased demand and a lack of availability. But we also noticed that there are fewer models and floor plans available than in previous years.

The RV Market is booming

The COVID-19 pandemic sparked high interest in RVs. Many families decided to take road trips instead of traveling by air. And the rise of remote work created a wave of digital nomads who could explore the country for weeks at a time without having to miss a day of work. According to the RV Industry Association (RVIA), more RVs were shipped in 2021 than any other year, and 2022 is projected to follow as the second busiest year on record.

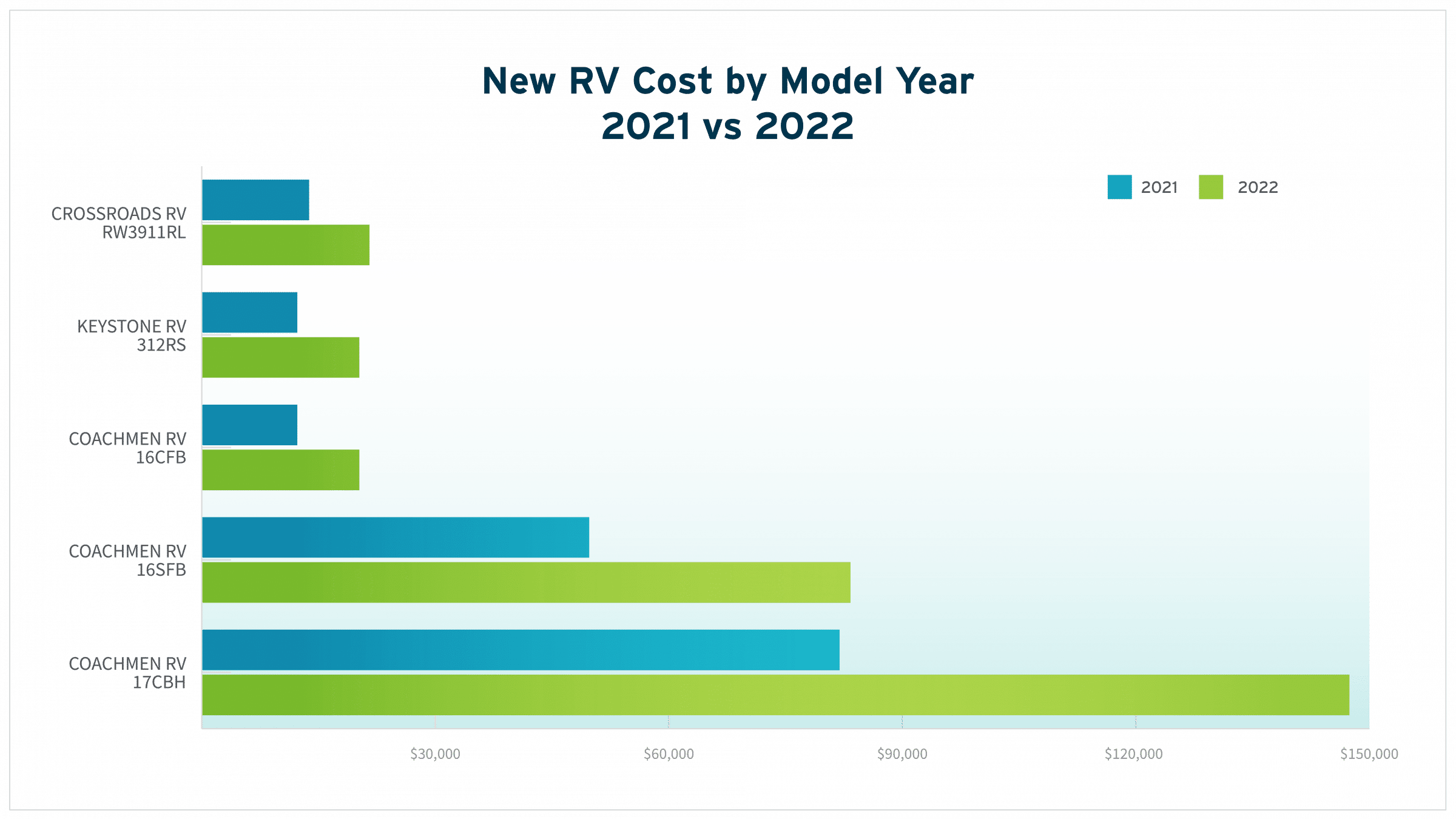

Unsurprisingly, there were large increases in pricing, just as we’ve seen for vehicles across the board. Like the heavy equipment and trucking markets, high demand is being met by production slowdowns caused by supply chain issues and labor shortages. With fewer models on the market, prices are increasing significantly.

There are fewer options on the market

One of the most surprising aspects of our research was just how many models/floor plans were no longer available. We found there were 1,306 models/floor plans made for 2021 that were not produced for the 2022 model year. And it’s not that they’re being discontinued to make room for new options—there are only 377 new models/floor plans for the 2022 model year, resulting in a net loss of 929.

When we tried to uncover the reasons why some of these models/floor plans were discontinued, there were no clear trends. In some instances, it may be a matter of working around production challenges. For example, the Thor Vegas 27.7 was discontinued in 2022, but the company still offers the Vegas model with the 24.1, 24.3, and 24.4 floor plans. The discontinued floor plan is significantly larger than those still in production. It’s possible that Thor is focusing on floor plans that use the same parts and manufacturing processes so they can produce them more quickly.

Underperformance may be another reason why manufacturers are discontinuing certain models/floor plans. The Forest River Rockwood 2508 travel trailer went from $36,040 MSRP to $34,644 (a 12% decline) between 2020 and 2021 before going out of production in 2022. A price decline in the midst of historically high demand indicates underperformance.

Grand Design discontinued the 328G and 353G floor plans of its Momentum model in mid-2021. In a recent news story, the company announced that consumers had expressed high interest in its 397THS, 395MS, 351MS, 23G and 30G floor plans, indicating that it’s paring down inventory to focus on the most in-demand options.

As consumers gear up to hit the road this summer, the market shows no signs of slowing down. The RVIA’s 2021 Go RVing RV Owner Demographic Profile, 9.6 million households are planning to buy an RV in the next five years. Even in the face of high prices and limited availability, the market is expecting continued growth, with young consumers leading the way.

Check your RV value

Curious about the value of an RV that you own or are buying? Price Digests provides single value lookups and annual subscriptions for RV values. RV data values are also available through our All-Access Package containing millions of data points for a wide range of vehicles and vessels.

About Price Digests

Since 1911 Price Digests has served the vehicle data needs of the insurance, finance, government, and dealer markets through its portfolio of VIN decoding, specifications, and market value data solutions for the commercial truck, passenger vehicle, marine, powersport, and recreational vehicle asset classes. Our data + intelligence solutions pave roads to faster and better decisions with perfect-fit data delivery, whether it’s seamlessly integrated APIs, online subscriptions or custom data delivery.