Enhancing Efficiency While Maintaining Accuracy in Commercial Insurance Underwriting

As an underwriter, you know it’s important to do your work well, but you know it’s equally, if not more important, to do your work efficiently. The quicker you can get your risk assessment and analysis done, the faster you can get your quote to the customer and bind the policy. But that means you have to balance the upholding of rigorous risk assessment standards while streamlining your workflow to meet the demands of your business.

Is that actually possible?

This article explores some current challenges in the underwriting process and different ways you can boost your underwriting efficiency, while maintaining or even improving your risk assessment accuracy.

Challenges in the Underwriting Process

If you’re looking for ways to streamline your underwriting efficiency, then you might already have an idea of what areas in your day-to-day need improvement. But there also might be more areas of which you’re not aware, such as:

Loss of Focus

An Accenture underwriter survey reported that up to 70% of underwriters’ time is spent on activities other than underwriting. According to their findings, 40% of their time is spent on administrative tasks, 30% on negotiation and sales, and the remaining 30% on actual underwriting. Over the next five years, Accenture estimates that this inefficiency will result in an industry-wide loss of roughly $160 billion.

Data Overload

Compute power and data volumes are rising significantly as the proliferation of connected devices and their transactional activity continues to accelerate. In fact, according to Exploding Topics, 90% of the world’s data was generated in the last two years alone. The paradox for the commercial underwriter is that while the availability of insights is rising, the ability to consume and make sense of it is deteriorating. Simply put, the underwriter is growing richer in data and poorer in actionable insights.

Because of this, underwriters often face data overload, grappling with an immense volume of information from multiple sources, such as financial statements, market reports, and customer data. It’s a struggle to quickly filter out the noise and pinpoint what’s necessary for adequate risk assessment.

But the amount of data that underwriters use is still necessary to accurately price risk and apply rates. Especially since over the past ten years, underwriters have started to feel less confident in the quality of their work. In 2013, Accenture sent out a similar survey where 63% of underwriters said their processes and tools were “superior”. But in their most recent survey, that number dropped to 46%.

Policyholder Demands

Underwriters feeling less confident in their ability to do their job well can create other challenges, like misapplying rates or mispricing the risk. When this occurs, it can develop into a tense working relationship between underwriters and policyholders. According to a World Report Series Property and Casualty Insurance report, 42% of policyholders find the underwriting process complex and lengthy and 74% of commercial insurance buyers expect greater pricing transparency.

But if underwriters aren’t confident in the accuracy of their risk assessments, how can they reassure their customers?

Let’s start by taking a closer look at some of these challenges and the different ways you can improve the efficiency and accuracy of your underwriting.

Improving Your Underwriting Efficiency and Accuracy

Here are some solutions and practices to address the challenges mentioned above:

Cutting Out Unnecessary Tasks

With most of their focus elsewhere, underwriters are finding it hard to prioritize their primary tasks. If you’re looking for ways to improve the efficiency in your underwriting, one of the initial steps is to improve the efficiency in your other daily tasks, or find ways to eliminate them altogether.

Technology offers one of the most effective solutions for this challenge. There are numerous products currently available that can streamline the administrative tasks of underwriters, but a lot of companies aren’t utilizing them.

An article from Risk and Insurance discusses how underwriters, when asked how new technology has impacted their work, said they saw improvements in quoting and selling, and evaluating risk and pricing. However, new technology has had much less of an impact on non-core/administrative tasks. In fact, almost two-thirds of respondents said that since they incorporated new technology into their day-to-day tasks, their workload has actually increased.

Though it’s unclear why that may be, whether it’s from technology with poor data or tools without API integration, what is clear is that ignoring the time-consuming administrative tasks isn’t making the jobs of underwriters any easier.

Using the Right Data Tools

Underwriters have frequently expressed concerns in the past that incorporating new technology into their processes has often had the unintended effect of increasing their workload. Additionally, they continue to experience data overload.

Does that mean underwriters should avoid new technology and data products altogether?

Absolutely not.

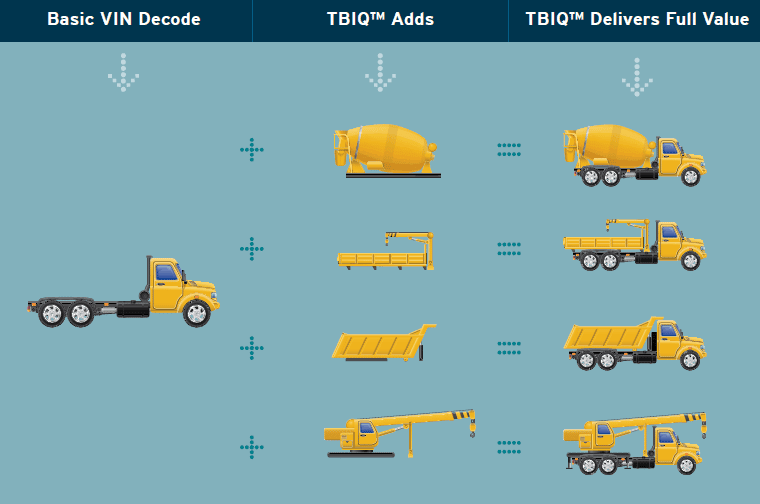

For instance, let’s say you’re trying to value a policyholder’s commercial truck. You’ve looked up the original cost new (OCN) of the truck, but found that it is an incomplete cab and Chassis, so you know the OCN is underreported because the value doesn’t account for the Body installed on the back of the truck. Now you have to somehow find the value of the truck body to incorporate that into the value and the risk assessment.

What does that entail? Using a completely different software or database? Complex calculations? Whatever the case, you’re staring down the barrel of data overload and a bigger workload thanks to the current data tools you have.

But, if you were using a more powerful data solution, such as the Risk Intelligence solutions powered by Fusable, you could take advantage of its TruckBody IQ® calculation. This solution provides you with an instant estimated OCN of a completed truck, including the value of the truck body. This increases the accuracy of your quote during the underwriting process while mitigating risk for the insurer.

Using data products that can help you accomplish more while maintaining accuracy is one of the best ways to avoid data overload while increasing your efficiency. If you have a ton of data products or databases that all require their own login and separate use, it’s going to hinder your ability to do your job quickly and accurately.

Improving the Insurance Customer Journey

Improving the insurance customer journey involves recognizing the diverse pain points each customer may experience. It’s crucial for underwriters to identify these pain points, whether they stem from complex policy language, lengthy claim processes, or even the price of the policy. Recently, Publicis Sapient surveyed 250 policyholders who interact directly with their insurers. Specifically, they asked why policyholders decided to switch insurance companies.

In their response, 70.1% of policyholders cited pricing as the reason. As you know, a high price isn’t something that an underwriter can always control. Often, the poor compliance scores of a customer cause their risk to go up, which causes the price to go up.

If you notice this with some of your customers, the first thing you should do is warn them about their current risk. Something they might not realize is that their lack of insurability could reduce their options in the insurance marketplace, and possibly cause them to pay exuberant costs.

But going above and beyond can not only improve your customer retention, but also lower the amount of risk that your insurance company is taking on. For instance, Fusable offers an affiliate marketing program for some of its products that allow your clients to use them as well.

This gives them the data to identify areas of risk they can reduce themselves, increasing their own insurability and reducing their insurance costs. And because it’s the same data used by insurance companies, it can also help openly communicate with your customers to improve transparency with their policies.

Future Trends of Underwriting Optimization

It’s smart to stay up-to-date on future trends and developments of underwriting optimization, so you can ensure your efficiency and accuracy is maintained. Here are some trends to keep an eye out for:

It seems you can’t open a social media app or news site without seeing some mention of AI. In fact, a lot of insurance companies have already adopted it into their workflows. In 2023, a survey conducted by Conning noted that 61% of respondents in the insurance industry had either implemented or were in the process of implementing AI into their workflows, and in 2024, that number jumped to 77%.

The three main areas of insurance that the survey examined included risk control and pricing, operations and claims process, and sales and underwriting. For underwriting specifically, AI algorithms are being used to enhance the accuracy and efficiency of the underwriting process.

That includes analyzing vast datasets, identifying patterns, and making correct risk predictions. AI can also help to streamline repetitive tasks, allowing underwriters to focus on complex decision-making and strategy instead of non-core or administrative duties.

And the adoption and inclusion of AI isn’t slowing down. The size of the global artificial intelligence market for insurance was estimated at $4.59 billion in 2022. However, it’s predicted to continue to grow, hitting a whopping $79.86 billion in 2032. That means, if you don’t already use AI in your workflow, chances are you will within the next few years.

But don’t fret. AI will never replace underwriters altogether.

The last thing an insurance company wants is a fully-automated underwriting process that starts handing out bad policies. Underwriters will remain essential because of their critical reasoning, which is key in interpreting nuanced risk factors that AI might miss and ensuring quality assurance of all policies. Even as insurance companies continue to adopt AI into their workflows, human expertise will always be critical in handling exceptional cases, maintaining ethical standards, and providing a more personalized touch.

Blockchain Technology

If you’ve heard of blockchain technology, you might identify it with cryptocurrency, but other industries and entities are becoming more interested in its use. That’s because blockchain technology can create secure and transparent records of transactions and claims. This decentralized system ensures that data integrity is maintained across all parties involved in the insurance process. But it also can contribute to a more efficient and optimized underwriting workflow.

That’s because, using blockchain technology, underwriters can automate different tasks, such as identity and document verification. It can also help execute and manage smart contracts. These contracts can automate various calculations and tasks for underwriters, including premium calculations, policy issuances, and even claims settlements. It sounds similar to AI, but blockchain technology provides additional security to the data it uses by running continuous checks against copies of itself to ensure the data is never compromised or changed by external parties.

Telematics and IoT Integration

Telematics and Internet of Things (IoT) integration are set to revolutionize underwriting by providing real-time data on insured assets. Devices such as GPS trackers in vehicles or smart sensors in homes will offer continuous monitoring, enabling underwriters to dynamically assess risks and tailor policies to individual behaviors and conditions.

For example, let’s say you’re analyzing the risk of a motor carrier (MC). Using telematics data, you can better understand the MC’s asset utilization. That includes assessing the vehicle’s usage, where it’s hauling its cargo, and how often it crosses state lines. You can even use telematics to better understand driver behaviors and how safely they operate their vehicle. This gives underwriters the tools they need for more accurate premium pricing and proactive risk management.

Fusable is currently in the process of integrating telematics into our existing analytics tools. Using this technology, we can provide a deeper level of data to perform more adequate risk assessments. We are currently planning to implement these changes to some of our analytical tools by late 2024.

In Conclusion

Enhancing efficiency and accuracy in commercial insurance underwriting is both essential and achievable by using advanced technologies and updating traditional workflows. The current challenges, such as excessive administrative tasks, data overload, and rising policyholder demands, are forcing underwriters to take a strategic approach to improve or optimize their processes. By making gradual changes and taking advantage of automation software and powerful data tools and solutions, such as those available through Fusable, underwriters can significantly boost their productivity and precision.