Bridging Customer Satisfaction Gap in Large Commercial Auto Lines of Business

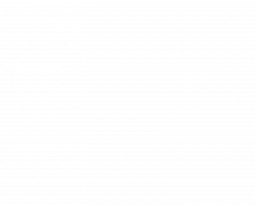

2018 was the year of the InsurTech rising and the commercial auto industry shifting focus to digitization options, their adoptions and implementations. The first half of 2019 passed with carriers assessing effectiveness of their systems against the needs of their customers. According to Tom Super, Director of JD Power P&C Insurance Practice, Geico and Progressive captured over 50% of the auto direct premium growth in 2018, just shy of $8 billion. Progressive, as reported in their latest earning release, attributes the 2018 growth success to focusing their attention on the high-end consumers. This segment proved responsive to the following product offering attributes – attractive pricing, superior customer service from independent agents, and new product features that included bundling of auto and home policies. The overwhelming positive business impact that translated into a differentiated positioning and increasing desired segment penetration from this strategy is evident in the below chart.

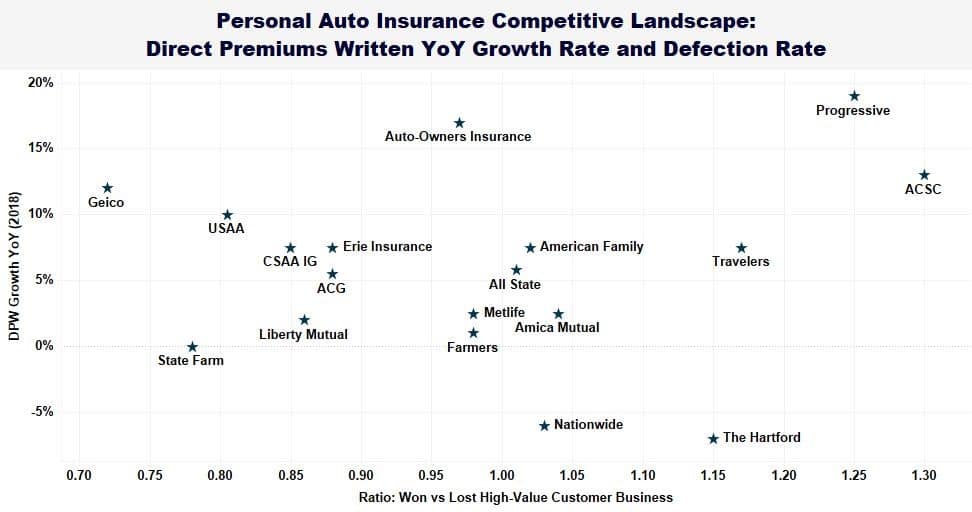

The 2018 J.D. Power Insurance Shopping StudySM collected NPS (Net Promoter Scores) for multiple personal auto carriers by region, as well. The averaged results are presented below:

The conclusions from these two studies suggest that many auto insurers are “missing the mark when it comes to meeting the expectations of this segment” (Super, 2019). High-value customers that present lucrative business niches are not treated any different by the carrier than the other less-profitable segments within their customer pool. The NPS scores show that the high-value customers do not rate carriers any higher than the lower-value customers. In fact, the Progressive NPS is below average.

JD Power argues that in order to grow their profitability and allow for growth in the crowded market place, carriers must find ways to treat their high-value, long-tenure customers differently. After all, these people spend more and expect a higher-degree of service in return for their loyalty. Additionally, insurers must look for new ways to offer their target customers the best UX tools that are able to solve complex customer product needs.

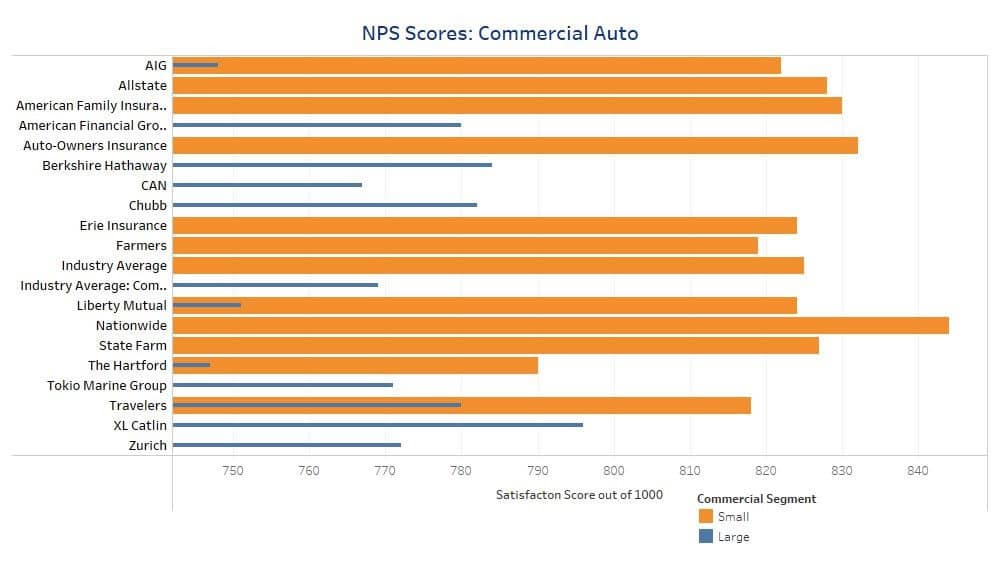

If we take these learnings from the consumer segment and apply them to the Commercial Auto segment, similar conclusions can be drawn. The 2018 JD Power study of the commercial auto carriers (Small Commercial and Large Commercial) uncovered the following difference in the net promoter scores:

It is interesting to note that if we liken the Large Commercial customers to the High-Value personal auto customers, we might find similarities in the share of revenue that these groups account for in their respective lines of business. The same comparison can be used for the Small Commercial customers and the lower-value personal lines customers. The Commercial Auto NPS scores above clearly illustrates a product satisfaction gap between the Small and the Large commercial auto customers. The reason for this gap is the difference in focus and business needs between these two customer segments and the lack of differentiation in the product proposition aimed at each one of these groups.

Large Commercial customers are efficiency-minded and demand tools that can help them scale their operations. They want complete automation and shorter processing times. The Small Commercial customers, on the other hand, depending on the size of their business, maybe more open to the legacy approaches posing fewer critical demands on the UX.

So, what should the Large Commercial carriers do to bridge the customer satisfaction gap? The answer to that lies in auditing existing business processes and reducing data inefficiencies that negatively impact customer experience. If not already there, Large Commercial lines should implement a holistic set of measures to address system-wide data process enhancements:

- Implementation of complete cross-system automation in underwriting and claims

- Optimization of legacy systems through direct asset data integrations across multiple business units to increase efficiency and decrease customer wait time,

- Standardization of asset data to be used across both – underwriting and claims

- Incorporation of risk quality through data-driven risk assessment rooted in accurate complete asset valuations. This methodology will allow to avoid coverage complications on the claims side if an insured event were to arise at a later date.

Price Digests offers comprehensive, direct asset data API integrations for all asset classes built with the future-proof technology that is robust and high-speed. We cleanse and standardize legacy data to reduce data handling cost and help with system digitization.

Sources:

Source: J.D. Power 2018 Large Commercial Insurance Study

J.D. Power 2018 Small Commercial Insurance Study

Super, T. High-Value Customers to Become the Next Insurance Battleground, June 12, 2019 Retrieved from https://www.mynewmarkets.com/articles/183449/high-value-customers-to-become-the-next-insurance-battleground

J.D. Power 2018 U.S. Insurance Shopping Study

Nadia Davis

Brand Marketing Manager

Price Digests

Asset Intelligence

Infrastructure intelligence | informa